For years, I created invoices for clients and tracked their payments using a simple Mac app called Billings 3. It cost me $50 or $60 bucks, and I used it for at least four years, without putting any additional money into upgrades. Billings was a solid program which I ran on my desktop Mac in the basement (aka my office), and it let me customize the look of my invoices, do estimates, email PDF invoices to clients, run basic reports, and see if any outstanding invoices hadn’t been paid on time.

Of course, over the last couple of years, invoice software has migrated into the Cloud (including Billings, which isn’t sold as a standalone app anymore), with tons of companies offering a variety of options. But I never paid much attention to any of them because they were all based on a subscription model that had me paying at least $100 annually, whereas my trusty Billings app cost me ZERO per year.

Problems With The Old Way

But then I started getting busier. I added more clients over the last few years, my wife and I started a family, and slowly but surely, time became constrained.

Having to go to to one particular computer in my house to generate an invoice or an estimate was becoming a pain. When I was working out of town for a few days, there was simply no way for me to get back to my desktop Mac. Other times, I found myself sitting on my comfy living room sofa at the end of a long day, and I didn’t want to trudge down to the basement to make an invoice.

Another problem was that I occasionally forgot to mark some invoices as paid. The checks would come in, but I couldn’t get to the computer for a couple of days. I wouldn’t forget to deposit the checks (naturally) but every once in a while, I’d forget to note them as received on the basement computer. Weeks later, I would think an invoice was still outstanding, get in touch with a client, and then apologize profusely when we determined I had fouled up.

So this year, I decided to try out a cloud-based invoicing service, and see if it was worth spending the extra money in exchange for a far easier time managing my cash flow. I looked at a few options such as Quickbooks Online, Zoho and FreshBooks, but settled on FreshBooks because it had some good word-of-mouth buzz, looked easy, and its subscription fees were middle of the pack.

Getting Started With FreshBooks

Now, I’ve been on FreshBooks for more than 7 months, and haven’t looked back. It’s truly been a pleasure to use, largely because of two factors:

- Ease of use. It’s been very easy to get new clients set up, create estimates, convert estimates into invoices (with or without modifications), and mark them paid when payments come in. It’s easy because of FreshBooks’ straightforward, clean UI, which features big colorful buttons for common actions, and common sense tabs like “Home”, “People”, Invoices”, “Estimates”, “Expenses” and “Reports”. I never had to look up how to do anything or contact technical support to get up and running (by the way, FreshBooks is fairly unique in that you can actually CALL tech support, and talk to a live human being, from 8am to 8pm EST— nice!).

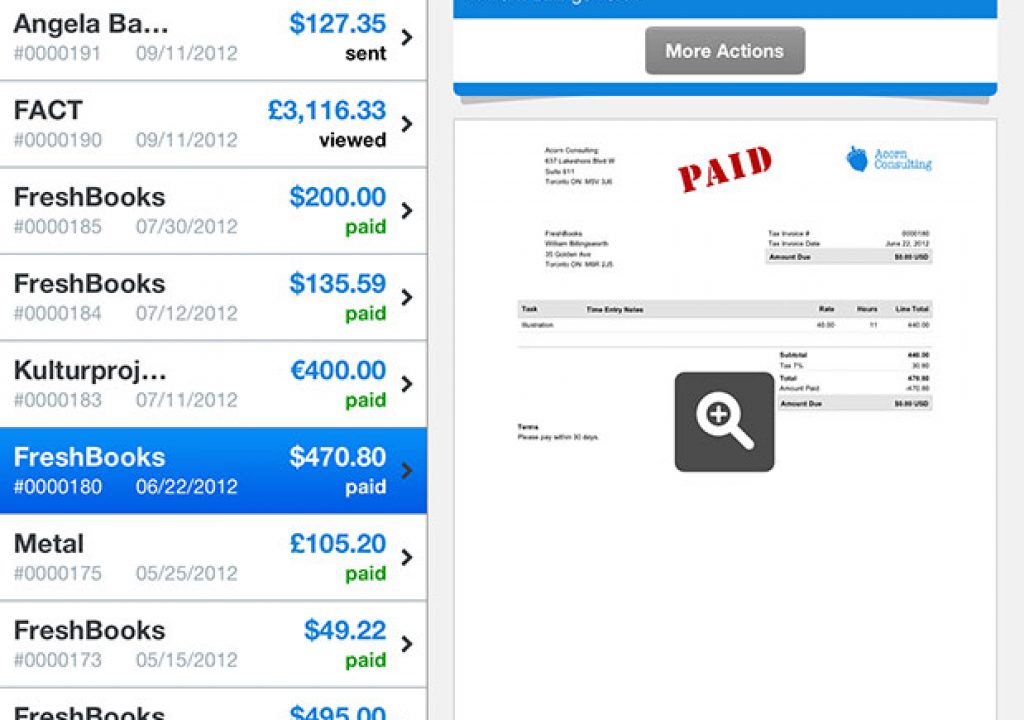

- Multi-device support. FreshBooks works through a web browser, but it also has fantastic iPhone and iPad apps which let you do pretty much everything you can do on the web browser with the exception of generating detailed reports (there’s also an Android app, but I never tried it). For me, this trio of browser/iPhone/iPad access points made it incredibly easy to get work done quickly, no matter where I was. Using the iPhone app, I created estimates while pulled over at a curb during a drive, and sent out invoices during lunch breaks on set. I used the browser and iPad app when doing web surfing on the couch, or during commercial breaks on Mad Men. With FreshBooks, invoicing went from being a task I had to put on my To Do list to being almost an impulse action, like checking a stock quote or sports score.

FreshBooks’ iPad app (an older version is shown here from a press photo) is very smooth. Same for the iPhone app.

What the Client Sees

When you create an invoice, your clients get an email that appears to be from you, though it’s really from FreshBooks (FreshBooks doesn’t use your account to send it, so you don’t have to share email credentials with the service). And in sending out dozens of invoices, I’ve only encountered one instance when a client said they didn’t get the email. I’m not sure if it went into a junk mail folder or what, but generally, I’ve found that the email delivery system is reliable.

Anyway, you can customize the text of the email with a personalized message, and add some database fields like the value of the invoice, the date of the invoice, etc. But the important part of the email is a link, taking the client directly to a FreshBooks web page that acts as your online invoice.

That page looks more or less like a standard invoice (easily printable for those who like paper), taken from all of FreshBooks’ *two* design templates (there’s “Classic”, which looks like every other generic company invoice you’ve seen, and “Clean”, which looks a little more streamlined with fewer table lines). Besides choosing from these two templates, you can choose a custom color for key information on the invoice, and you can add a company logo or picture. Obviously, if you’re hoping to give your invoices a totally unique look, you’ll be disappointed with FreshBooks’ limited options. At the same time, for the vast majority of clients, an invoice is an invoice.

This is what a client sees when they click the link taking them to your invoice. They can pay online or print out to paper.

Clients, when looking at their invoice, can also see an easy summary of all the other invoices they’ve paid to you, as well as what’s outstanding. It’s a nice touch that lets clients monitor their accounts’ status without having to get you involved.

Clients can always pay your invoice outside of the FreshBooks system (send a check, etc.), but you can give them the option of paying online through Paypal services, or through FreshBooks’ own credit card service. For Paypal, there are two options: Paypal Standard takes between 1.9% – 2.9% of your invoice plus $.30, while the Paypal Business option takes just a flat $.50 fee, but the client’s payment funds have to come from their Paypal balance, or an eCheck. Outside of Paypal, FreshBooks can also handle all direct credit card processing and deposit the funds into your bank account, taking the usual 2.9% plus $.30 per transaction. Personally, I haven’t found too many of my clients hankering to pay by credit card, and I definitely don’t like the idea of losing 3% of my invoice to fees, but if credit card payments are useful to you, FreshBooks makes it about as easy as it can be.

What You See

Once you’ve sent an invoice to someone, FreshBooks maintains an “Invoice Autobiography” for it, letting you know exactly what your client has done with it, and when. For instance, any given invoice’s autobiography might report that it was created on July 31, emailed to the client that same moment, viewed by the client 4 days later, and printed by the client a day after that. So there’s no wondering if you’re invoice went into a black hole.

You can see those autobiographical details at the bottom of every invoice you create, but you can also see a list of all invoices, with their status printed in a dedicated column. Viewed, Paid, Sent, Paid, Viewed, Viewed, Sent, Draft and so on. Again, it’s a great way to quickly see where all your invoices are as they make their slow but steady march towards your bank account.

From your end, each invoice features an “autobiography” showing a time and date stamp for every related action.

FreshBooks also lets you generate a number of reports on your finances. There are typical accounting reports (Balance Sheet, Expense Reports, Profit and Loss, Tax Summary), client breakdowns, Time to Pay, and many more. You can give your accountant access to these reports as well, saving you time from acting as the middleman.

Finally, FreshBooks has a well-thought out home page that gives you a nice overview of the important aspects of your business. Bar charts showing billings vs expenses. The dollar figure for total outstanding invoices. A pie chart of expense categories. Credit card payments making their way to your bank account, and so on.

The FreshBooks home screen gives you a great overview of where you stand financially.

Advanced Features

FreshBooks also has some advanced features that are available on some pricing tiers (more on those tiers below), including:

Every tier lets you track your time by project and task, and then turn that into a line item on a client’s invoice. You can do all this right from the browser, or from the iOS apps, and the interface for quickly getting a timer running is streamlined, so it doesn’t feel like a hassle to get started. You can also enter time values into Monthly, Weekly and Daily time sheets, if that’s something clients expect. At any rate, I don’t personally do much time tracking, so if it’s something that’s important to you, you’ll probably want to get a second opinion, but the feature set seems pretty complete to me.

Also available on every plan is the ability to track the expenses you wrack up while doing work for clients. You can set up FreshBooks to monitor your bank account and credit cards, and automatically download any expenses on those accounts. FreshBooks tries to guess how to categorize each expense (Repairs and Maintenance, Bank Fees, Gas, Meals, etc.) but for those it doesn’t know how to categorize, its slick interface makes it easy for you to fill in the gaps. It also learns from your choices, so if you categorize a vendor like “Wooden Nickel Lighting” for rental gear on one expense, any other charges from that vendor will use that categorization. You can also select any expense or group of expenses, and automatically convert them into line-item expenses on an invoice, which saves a lot of time when you’re passing expenses on to clients.

Finally, a couple of tiers include high-end features for project management, such as creating projects, assigning project managers, managing team time sheets and expenses, and allowing multiple users to log into your FreshBooks account. I didn’t try these features because they go beyond my current needs this year, but they do appear to position FreshBooks to handle businesses considerably bigger than your typical “Army of One” freelancer.

Pricing

Here’s the only chink in FreshBooks’ armor, as far as I can tell.

FreshBooks offers a handful of feature tiers, but the most basic tier is called Sprout, and it costs $9.95 a month. For that, you get most of FreshBook’s features, including time tracking and expense management. That’s a great feature set for $9.95 a month, but the only problem is that you can only manage five clients at a time. That means if you’ve created five clients in the FreshBooks database, and you get a sixth, you have to delete one of the existing clients from your database to make room for the new one. And if you do work for that deleted client again, you’ll have to manually enter them in again (and get rid of someone else).

Deleting and creating new clients just takes a minute, but it’s still a bit of a hassle. The bigger problem is that if you delete a client, any outstanding invoices you’ve created for them get deleted, and the links to those online invoices go away too, so the client has no way of viewing their invoice. FreshBooks says you can always call tech support to get those missing invoices back via some tech support voodoo, but that seems like a lot of trouble. My guess is that paying $120 a year with a five-client cap will create enough headaches to make the otherwise joyful experience of using FreshBooks pretty frustrating for many video freelancers.

The next FreshBooks tier is called Seedling ($19.95 a month), and for that your client roster maxes out at 25 clients, which is much more manageable (I’m at about 19 clients after starting fresh in January 2015). You don’t get a few of those high-end project management features I mentioned earlier, but you probably don’t need those anyway. But $19.95 comes out to $240 a year, which is a fair amount of money for what’s not necessarily an essential service, albeit certainly a convenient one. And if you don’t want to deal with a 25-client cap, you’ll spend an extra $10 a month, bringing you to $360 a year, which also adds those project management features, and the ability to add another user to your account.

This kind of pricing structure makes FreshBooks a great service if your business is consistently thriving and bountiful, and I would highly recommend it. On the other hand, most self-employed video folks I know encounter a mixture of bounty and leanness, and spending $240-$360 a year for cloud-based invoicing will seem like an unnecessary luxury to many. This is especially true when many people in our business probably create less than a dozen invoices each month, from a mixture of clients.

Personally, I think FreshBooks could appeal to a huge number of people if it offered a tier that cost no more than $9.95 a month, gave up some of the non-invoicing features such as expense tracking or online payments, but offered a far greater number of clients (15 or 20+). My guess is that FreshBooks wants features like expense tracking and credit card services to be available to everyone, because those features position FreshBooks as a more comprehensive tool for running a small business that goes beyond just invoices.

Fair enough, but I still think a lot of people will want to take small steps to get to that ultimate destination. Making FreshBooks’ excellent invoicing features available at a lower price (or without the hamstringing of a five-client cap) would open up FreshBooks to far more people in video production, and help it become a standard in the industry.

Summing It Up

Pricing aside, FreshBooks has been a pleasure to use, and a bit of an addictive drug— once you get used to it, it’s hard to imagine life without it. I’m looking forward to seeing how the service evolves going forward, and also beginning to work some of its more advanced features into my own workflow.

Pros

- Very easy and convenient for you and clients

- Lots of features, and support for group projects

- Awesome iPhone and iPad apps in addition to browser-based service (Android available too)

- Free phone-based tech support if you need it (not too likely)

Cons

- Pricing tiers feel a little out of synch for typical video freelancers

Helmut Kobler is a Los Angeles-based Director of Photography and Cameraman at www.losangelescameraman.com